Work

Topics such as Jobcenter, recognition and looking for work

"Mini-Jobs" in Germany

From students and pensioners to stay-home mothers/fathers or even employees, many get so-called "mini-jobs" to earn something extra on the side. Here you can learn what a mini-job actually is and what you have to consider as someone with a mini-job.

Certified Copies

You have most probably heard the term "certified copy" ("beglaubigte Kopie") or the phrase "you need to have your documents/certificates authenticated" in Germany. In particular, when applying at university or the Civil Registry Office ("Standesamt"), you are required to submit a certified copy of your diplomas or documents. Here you can learn what a certified copy is and how you can make a certified copy of your documents.

Employment Contract

Searching for the proper job can be tedious- but it is fabulous when you finally get a "yes" from a company you like. Before you sign the contract and start to work, you should examine the proposed employment agreement thoroughly.

German for Work

If you would like to continue learning German after the integration course (or any other German course), you may be able to participate in and benefit from an occupational language course. These courses are known as "Deutsch für den Beruf" or "berufsbezogene Deutschsprachförderung". A work-related German course can provide you with the opportunity to gain a foothold in the German job market and improve your qualifications.

How do I find out what is the right job for me?

As a child, when we were asked "What do you want to be when you grow up?" we surely had some answers ready. Later, this question is often not so easy to answer. There are many different professions, and not many are able to choose a specific vocational training or university degree without having to face hurdles. That's why the Employment Agency has put together lots of informational contents and developed various tools to help you choose a career path.

Illegal Employment

Anyone who works in Germany, in principle, has to pay taxes and make social security contributions. When one doesn't, their employment is considered undeclared and illegal – and undeclared work is no small matter: both employees and employers face severe penalties if employment is not properly registered. Here you will learn how to recognise undeclared work and illegal employment, what you need to consider and where you can find help. You will also find out whether undeclared work could adversely affect your stay permit.

Internship

Doing an internship helps you to gain work experience and can considerably improve your job opportunities. In many schools and universities, the students are expected to take part in a compulsory internship during their studies. Here you will learn about your rights as an intern, the benefits of doing an internship, and the crucial issues you need to consider before starting your internship.

Job Hunting and Application

The job market in Germany has numerous rules and regulations. In addition, you must meet some requirements to get a job. Many employers choose their employees mainly based on their certificates or degrees in the desired field. But even without the relevant certificates, you still have a chance to find a job.

Here you will learn about the steps you need to take to start your first job in Germany and the ways you can increase your chances of finding your dream job.

Here are two essential points you need to consider in advance:

- German is spoken in most companies in Germany. In some cases, English will do; but for most jobs, you need to be able to communicate in German. There are many ways to learn German or to improve your proficiency. Find out more in our chapters on "Language".

- You need a work permit before you can start to work in Germany. For migrants, the work permit is directly linked to the residence permit. You can find out more about this in our chapter "Migration to Germany". If you have fled to Germany, whether you can work or not depends on your current residence status. You can find out more in our chapter "Work Permit for Refugees".

Jobcenter

The Jobcenter can provide you support if you live in Germany and do not have enough money to care for yourself and your family. Under certain conditions, the Jobcenter helps people who have never worked in Germany, those who have been unemployed for more than a year and individuals who earn little despite working. If you are in one of these groups, you can seek financial support for yourself and your family from the Jobcenter. Such support is called „Citizen’s Allowance“ or„Bürgergeld”. It is the successor of the "Arbeitslosengeld II", which was also known as "Hartz IV". The Jobcenter staff will also help you look for a job. Jobcenter can also take over the costs for German courses or further training programmes if it can help you find a job.

Labour rights

Labour law in Germany is very complicated as there are numerous regulations in several bodies of law regarding the subject. However, it is crucial to know your rights and obligations as an employee. You can only demand your rights if you are aware of them.

Parental Leave ("Elternzeit")

Parental leave ("Elternzeit") is a leave from work for which the parents of babies and young children can apply. If you want to spend more time with your child, you can "go on parental leave". During this time, you do not work or do so only for limited hours. Mothers are not the only ones who use such an opportunity in Germany. More and more fathers apply for parental leave so that they can spend more time with their child in the first years of his/her life. After parental leave, you can return to your previous job.

To learn about the financial options you and your family have during parental leave, check our chapter "Parental Allowance".

Recognition of foreign certificates

If you have obtained your school or vocational qualification outside Germany, you can have it recognised here. Unlike vocational qualifications, your university/school qualifications may already be recognised: you can check the official portal Anabin to see whether your school, university, and degree are listed as recognised. You can read more about this in ‘How can I find out whether my qualification is categorically recognised?‘

In the recognition process, your degree is compared with a similar German degree. When your qualification is verified as an equivalent to the corresponding German degree, your diploma is "recognised", and you will have better chances in the job market.

All people with foreign qualifications have the right to this recognition process- it does not matter what residence status or nationality you have.

Please note: People who are still abroad sometimes have to provide relevant documents (e.g., training place, job offer) to prove that they intend to pursue vocational training or employment in Germany. If that is the case, you can also have your professional qualifications recognised in Germany.

*This information page has been updated with the support of the IQ Network NRW.

Retiring in Germany

People who stop working because of their age are called retirees or “Rentner*innen.” When people are older, they no longer have to go to work; instead, they receive a monthly pension. These individuals are called "pensioners." The current retirement age in Germany is 67.

Many are worried that they will not have enough money as they go into retirement. Poverty among pensioners is, in fact, a growing problem in Germany, in particular, for those who did not earn much during their working years. It is, therefore, all the more essential to deal with the issue of pension early on and before reaching retirement age. Here, we explain how the statutory pension system works in Germany and what other pension options there are.

Sick Leave

When you are sick and unable to work, you are entitled to rest at home. However, your employer has the right to demand proof; i.e. confirmation of illness/unfitness for work - which you can obtain from a doctor. Colloquially, such a document is known as "Krankschreibung" (sick note), but the official term for it is "Arbeitsunfähigkeitsbescheinigung " (certificate of unfitness for work) or -for short- "AU".

Social Insurances

Germany has an efficient social security system which covers those who are insured against unemployment, illness, long-term health issues, occupational accidents and old age. In Germany, insurance regulations are set by the state. The benefits are paid (according to the regulations) by the so-called "Sozialversicherungsträgern" or social insurance providers, i.e. the health insurance companies, the trade associations, the Employment Office ("Arbeitsamt") and the German Pension Insurance ("Rentenversicherung").

Starting up a Registered Business ("Gewerbe")

Many people dream of working as self-employed and being their own boss so that they can work independently or realise a business idea. Starting your own business is called "Existenzgründung". As an independent business owner, you are the one who decides which jobs to accept or how and when to work. But working independently also requires a lot of effort: you are personally responsible for everything and have to take care of many issues. Furthermore, there are always financial risks involved in building a business: if you invest significant capital, but your business does not make much profit, you will lose your investment.

As someone who starts up a business or founds a company, you are considered to be a businessperson or "Gewerbetreibender". When you, for instance, open a shop, restaurant, factory or craft business, you need to register your business ("Gewerbe"). If you practice a liberal profession ("Freie Berufe"), e.g. you are a journalist, doctor, etc., you can find all the information you need in our chapter "Starting a business as self-employed ("Freiberufler")".

Starting up as Self-Employed ("Freiberufler")

Many people dream of working as self-employed and being their own boss. Starting to work as self-employed is called "Existenzgründung”. As a self-employed person, you are the one who decides which jobs to accept or how and when to work. But self-employment also requires a lot of effort: you are personally responsible for everything and have to take care of many issues. Furthermore, you do not receive a regular fixed salary.

In this chapter, you will find essential information required for starting self-employment in a so-called Liberal Profession ("Freien Beruf"). If the job you practice is not categorised as a liberal profession and you are not a "freiberufler", visit our chapter "Starting up a Registered Business ("Gewerbe")" to find the essential information you need about self-employment for tradespeople.

Student Jobs

You may have to earn money on the side while you study because the BAföG or other financial support you receive is not enough for a living. Or maybe you do not even receive any financial aid- then the only option left is to work and study at the same time. However, having a part-time job ("Nebenjob") can also help you start gaining work experience and establishing professional contacts, even if your student job is not in your future field of work. When it comes to student jobs, there are often many questions: Do I have to pay taxes? What type of insurance should I have? Does my part-time job affect my entitlement to BAföG? Here we answer the most crucial of these questions.

Subcontracted Jobs

Subcontracted labour ("Leiharbeit") is also known as temporary employment or temporary work. Subcontracted workers sign a contract with a company which "lends" them as employees to various other companies. When you have an employment contract with a temporary employment agency, you will be temporarily sent to other companies which are in urgent need of staff. Although you will work for the designated company, you will not be considered a regular staff, as the temporary employment agency will be paying your wages. The temporary employment agency remains your employer, i.e. for instance, they will be the authority at which you need to apply for your holidays, and they cover your social insurance contributions.

Please note: Subcontracted work does not mean "short-term work". As a subcontracted worker, you are mainly employed by your temporary employment agency and only occasionally change the company in which you work. The contracts signed between the workers and the temporary employment agencies are usually open-ended.

Temporary employment is often available in the metal and electronic industries as well as the security, logistics, transport, administration and office sectors. In general, however, one can do temporary work in any industry. Even unskilled workers are sought-after and hired by temporary employment agencies.

Support for Jobseekers

Finding a job or vocational training programme in a new country is far from easy. However, you can benefit from various support offers from the Jobcenter and Employment Agency during your search in the German job market. These programmes can, for instance, help you search for a job, prepare your job application or provide you with a voucher for a preparatory training course to improve your chances in the job market.

In this chapter, you will learn about the types of support available and how you can seek help.

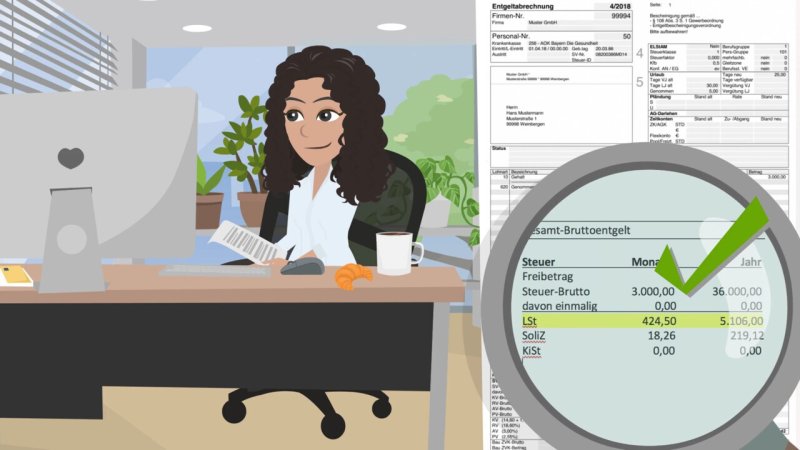

Tax Declaration

The tax return has to do with the most notable tax we pay: the income tax ("Einkommensteuer"). Income tax is deducted from the money you earn over the year, i.e. your salary as an employee, your income from self-employment, as well as, for instance, the interest you win from your savings or rental income. You can learn more about different types of tax in our chapter "German Tax System".

Tax returns are handed to the Tax Office ("Finanzamt") once a year. Whether you have to file a tax return depends on various factors. In principle, self-employed individuals and entrepreneurs are required to file a tax return and must ensure they disclose their incomes to the Tax Office and transfer the due taxes. If you are employed, however, it is your employer who deducts the due income tax (as "Lohnsteuer") from your salary and transfers it directly to the Tax Office. So, as an employee, you often are not obliged to file a tax return. Nevertheless, it may be worth the effort because the Tax Office may have collected more than it was due. Therefore, filing a tax return can possibly mean the Tax Office will refund you.

Termination of Employment Contract

Prospect of dismissal makes almost every employee nervous. But not every contract termination is legally valid. It is, therefore, crucial that you understand your rights and know what to do upon dismissal or in case you decide to quit your job.

The German Tax System

Each time we go to a supermarket or café, drop by at a gas station or receive a payroll, we are paying taxes. Taxation is the primary source of revenue for the state and enables the government to perform its duties. The German state is responsible for funding Kindergartens and schools, universities and hospitals, construction of roads, the salaries of teachers, police officers, firefighters, politicians and much more. Without tax revenues, the state could not fulfil such responsibilities.

Collecting revenue, however, is not the only reasons for taxation. There are, in fact, two other grounds for taxation. Through the taxation of harmful things, such as cigarettes, the state tries to improve behaviours. The cigarettes are expensive as a result of the tobacco tax; so that some give up smoking due to its high cost. Furthermore, social justice should be promoted through taxation: those who earn more must pay more taxes than people with less income.

Visa and residence permit for the recognition of professional qualifications

Recognition of foreign qualifications enables those who have completed their training abroad to work in their profession in Germany. The recognition process takes place at the so-called "recognition offices "("Anerkennungsstelle"). However, foreign qualifications occasionally do not meet all the necessary criteria for full recognition. When that is the case, you can attend a qualification programme in Germany, such as a technical training course or a job-related German course. To participate in qualification programmes in Germany, you need a corresponding entry visa and must later apply for a residence permit in accordance with §16d Residence Act in Germany.

Good to know: If you would like to have your qualifications recognised in order to work in Germany, you can also apply for a residence permit in accordance with Section 16d (3) Residence Act. To do so, you must prove the job in question is a qualified job. (There are individual exceptions or exemptions for church work or care-related professions).

You can also obtain a residence permit if you wish to undergo a so-called “Qualifikationsanalyse” (qualification analysis) or take part in an examination in Germany. This type of residence permit is issued for a maximum of 6 months. You will usually also need A2 (CEFR) language skills, depending on your qualifications. In addition, you must be able to prove that you have already been invited to a ‘qualification analysis’.

Visa for Jobseekers

Many companies in Germany are looking for skilled workers. With a sought-after professional qualification, you can come to Germany to work and live here. But finding a job from abroad is often a challenge. That is why according to section 20 of the Residence Act, you can obtain a visa or a residence permit for job hunting in Germany. This way, you can enter Germany legally and then look for a suitable job on-site.

Work Permit for Refugees

You need a work permit before you can start to work in Germany. And whether you would be issued a work permit depends on your residence permit. Here you can learn more about the regulations which apply to you when it comes to obtaining a work permit in Germany.

If you are not a refugee, you can visit our chapter “Immigration to Germany” to learn when and how you can apply for a work permit and enter the German job market.

Works Council and Union

Works councils and unions are designed to protect the rights and interests of employees. Works councils are active in individual - larger - companies- and unions represent the interests of workers in specific industries. Here you can find out what the works council and union do and how you can become a member.

“Opportunity Card” for Jobseekers

“Chancenkarte” or the Opportunity Card (as per §20a, b Residence Act) will be available from June 2024. Qualified professionals will thus have the opportunity to obtain a stay permit to look for a job in Germany. To obtain an Opportunity Card, you must meet certain requirements. Below, you can find what you need to consider.

*This information on this page has been reviewed and verified by our consulting lawyer Astrid Meyerhöfer.