Tax Declaration

The tax return has to do with the most notable tax we pay: the income tax ("Einkommensteuer"). Income tax is deducted from the money you earn over the year, i.e. your salary as an employee, your income from self-employment, as well as, for instance, the interest you win from your savings or rental income. You can learn more about different types of tax in our chapter "German Tax System".

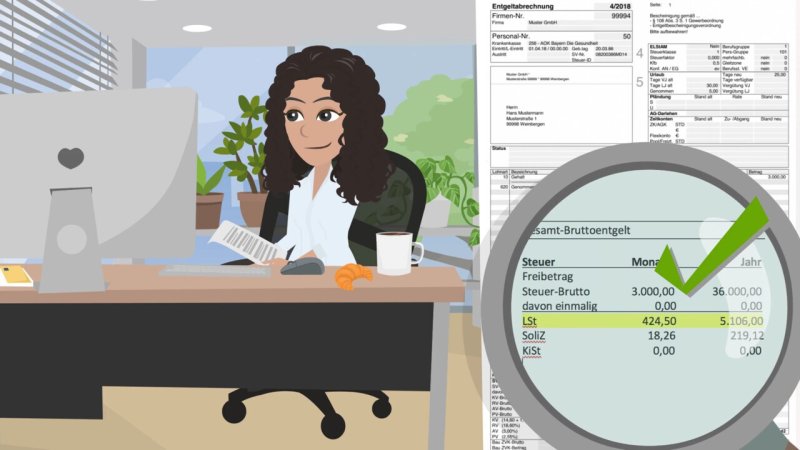

Tax returns are handed to the Tax Office ("Finanzamt") once a year. Whether you have to file a tax return depends on various factors. In principle, self-employed individuals and entrepreneurs are required to file a tax return and must ensure they disclose their incomes to the Tax Office and transfer the due taxes. If you are employed, however, it is your employer who deducts the due income tax (as "Lohnsteuer") from your salary and transfers it directly to the Tax Office. So, as an employee, you often are not obliged to file a tax return. Nevertheless, it may be worth the effort because the Tax Office may have collected more than it was due. Therefore, filing a tax return can possibly mean the Tax Office will refund you.

The German Tax System

Each time we go to a supermarket or café, drop by at a gas station or receive a payroll, we are paying taxes. Taxation is the primary source of revenue for the state and enables the government to perform its duties. The German state is responsible for funding Kindergartens and schools, universities and hospitals, construction of roads, the salaries of teachers, police officers, firefighters, politicians and much more. Without tax revenues, the state could not fulfil such responsibilities.

Collecting revenue, however, is not the only reasons for taxation. There are, in fact, two other grounds for taxation. Through the taxation of harmful things, such as cigarettes, the state tries to improve behaviours. The cigarettes are expensive as a result of the tobacco tax; so that some give up smoking due to its high cost. Furthermore, social justice should be promoted through taxation: those who earn more must pay more taxes than people with less income.