Childcare is a big topic for all young parents. And it is not always easy to reconcile work and family. In Germany, the estate provides so-called "Elterngeld" to support young families. "Elterngeld" or parental allowance serves as financial compensation for parents (or legal guardians) who temporarily have a lower capacity for work or cannot work at all after the childbirth as they care for their children. You can also apply for a parental allowance if you did not work before childbirth. Read further to find out if and how you can receive a parental allowance.

Parental allowance is financial compensation for parents and legal guardians who look after a child/children. You can receive parental allowance from the day your child is born. However, you can only apply for parental allowance after childbirth. You can do so retrospectively during the first 3 months after the child is born. It is better to apply for parental allowance based on the exact date of childbirth (your child's exact age) rather than calendar months because if you calculate according to calendar months, you will receive less parental allowance. You can receive parental allowance, at most, until the child is 2 years and 8 months old. You can find out how to apply for parental allowance in the section "Where and how can I apply for parental allowance?"

There are different types of parental allowance: Basic Parental Allowance (“Basiselterngeld”), Parental Allowance Plus (“Partnerschaftsbonus”) and Partnership Bonus (“Partnerschaftsbonus”). The amount of parental allowance depends on the parental allowance variant you receive and your taxable income. You can find out more in the sections "How long will I receive parental allowance for?", "What is Basic Parental Allowance?", "What is Parental Allowance Plus?", "What is the Partnership Bonus?" and "How much parental allowance do I get?".

You can receive a parental allowance, if:

- You live with your child in Germany,

- you have the custody of your child,

- you work (on average) up to 32 hours per week in a month (if the child was born before 01.09.2021, up to 30 hours per week).

You also need to have:

- a residence permit, including a work permit (Permanent residence permit, Permanent EU residence permit, EU Blue Card, ICT Card and Mobile ICT Card) or

- a residence permit that entitles or has entitled you to work for at least 6 months (exceptions to this general rule are listed in the Federal Parental Allowance Act under § 1 entitled persons, paragraph 7, points 2a and 2b), or

- a “Beschäftigungsduldung”, or

- German citizenship or

- the citizenship of an EU country (including Iceland, Lichtenstein, Norway, Switzerland).

Please note: If your residence permit has been issued according to §23 paragraph 1 (with the addition "wegen eines Krieges im Heimatland"), §23a, §24 or §25 paragraph 3 to 5 of the Residence Act, you must also meet ONE of the following requirements to benefit from parental benefits:

- You must be employed, on parental leave or collect unemployment benefits I or

- you must have been in Germany for at least 15 months.

Good to know: Work is not a requirement for entitlement to parental allowance. Employees, self-employed individuals, civil servants, unemployed persons, students, those under vocational training, and stay-at-home parents can apply for a parental allowance. However, people with higher incomes are not entitled to a parental allowance. That means if you earn more than €250,000 (or you and your co-parent earn more than €300,000) per year, you are not entitled to a parental allowance.

Important: The income threshold for entitlement to parental allowance will be lowered. For childbirths happening on 1 April 2024 or later, parents (or joint legal guardians) cannot apply for parental allowance if they have a combined income of €200,000 or more per year. And single parents will not receive parental allowance if they have an income of €150,000 or more per year. From April 2025, a combined income limit of €175,000 will apply for parents who care for the child together.

The parental allowance pertains to your biological children, the biological children of your partner, and foster- and adopted children. In exceptional cases, you can also receive a parental allowance for your grandchildren or nieces and nephews. But such is only possible if the child's parents are not capable of taking care of the child.

Important: Parents with a temporary residence permit or “Aufenthaltsgestattung” (in an ongoing asylum procedure) generally do not receive parental allowance. In principle, parents with a “Duldung” (except for those with a “Beschäftigungsduldung”) do not receive parental allowance either.

Yes. You can receive a parental allowance, although your child spends the days in a kindergarten or with a childminder. (i.e. a "Tagesmutter" or "Tagesvater") You can read more about childcare in our chapter "Childcare".

No. Parental allowance does not depend on parental leave. That means you can work while receiving “Elterngeld”, however, only part-time.

-

if your child was born before 01.09.2021, you cannot work (on average) more than 30 hours per week in every given month

-

and if your child was born after 01.09.2021, you cannot work (on average) more than 32 hours per week in every given month, to be entitled to parental allowance.

The duration of the time in which you receive parental allowance depends on the variation of parental allowance for which you opt. There are three types of parental allowance: the Basic Parental Allowance ("Basiselterngeld "), the so-called "ElterngeldPlus" and the so-called Partnership Bonus (“Partnerschaftsbonus”). You can also combine the Basic Parental Allowance and the "ElterngeldPlus" and apply for Partnership Bonus as well.

You have the option of receiving parental allowance continuously, but can also pause your parental allowance and continue receiving it at a later date. Or alternate with the other parent/legal guardian in receiving parental allowance. If you combine the parental allowance variants, you can receive the parental allowance for up until your child reaches the age of 32 months, i.e., 2 years and 8 months.

Good to know: If your child is born before the estimated due date, you will receive additional months of parental allowance– from 6 to 16 weeks (or more), you will receive between 1 and 4 additional months of parental allowance.

Basic Parental Allowance is particularly interesting for parents/legal guardians who work only a few hours or not at all after childbirth. In general, you can only receive Basic Parental Allowance until your child reaches the age of 14 months. After the 14th month, you can only apply for Parental Allowance Plus or Partnership Bonus.

If only one of the parents/legal guardians applies for Basic Parental Allowance, you can receive “Elterngeld” for at least 2 and a maximum of 12 months for each child.

With the Basic Parental Allowance, the parents can receive a parental allowance for 12 months per child. If you share the rights to Basic Parental Allowance with the other parent/legal guardian, you can receive Basic Parental Allowance for 2 more months. The two extra months are known as “Partnermonate” or “partner months”. That means you can share the parental allowance you receive during these 14 months with the other parent/legal guardian as you see fit–each parent can claim parental allowance for at least 2 and a maximum of 12 months. Please note: When both parents/legal guardians receive “Elterngeld” during the same month, it counts as 2 months of “Elterngeld”.

Requirements for the “Partnermonate” or “partner months” (the model is initially designed for two parents/legal guardians):

- Both parents/ legal guardians need to apply for parental allowance–one of them receives parental allowance for at least 2 months.

- At least one of them must have been working before childbirth and now earn less.

If you are a single parent, however, you can also apply for „Partnermonate“ and receive 14 months of Basic Parental Allowance.

Please note: For childbirths from 1 April 2024 and later, one of the two “partner months” must be taken in the first 12 months of the child's life. And only during this month can you and the other parent/legal guardian receive parental allowance simultaneously.

Important: You can only apply for parental allowance after childbirth. You should apply within the first 3 months after the delivery since parental allowance is only paid retroactively for a maximum of 3 months after the application is submitted.

You have the option of combining Basic Parental Allowance with Parental Allowance Plus. If you fulfil the requirements, you can also apply for the Partnership Bonus or “Partnerschaftsbonus”.

“ElterngeldPlus” is particularly beneficial for parents/legal guardians who want to continue working part-time after childbirth.

With "ElterngeldPlus", parents can receive (together and per child) a parental allowance for a double amount of time, i.e. 24 months. If you do not work at all after childbirth, you will only receive half of the Basic Parental Allowance each month. However, if you continue to work part-time after childbirth, your “ElterngeldPlus” can be as high as the Basic Parental Allowance.

You can receive an additional four months of "EltergeldPlus" if both parents/legal guardians work between 25 and 30 hours per week during this time. As a single parent, you can also receive these four additional months of parental allowance.

Parents can also decide whether they like to convert one month of parental allowance into two months of Parental Allowance Plus. Basic Parental Allowance can be paid for a maximum of 14 months; if converted into Parental Allowance Plus, it can be paid for a maximum of 28 months. It is up to parents whether they only want to claim Basic Parental Allowance or only Parental Allowance Plus, or whether they want to combine the two.

Important: If you receive Parental Allowance Plus after your child is 14 months old, you can no longer pause and continue receiving it again later. If you do, you will lose your entitlement to Parental Allowance. What you can do instead is divide the Parental Allowance Plus between yourself and the other parent/legal guardian. You can receive Parental Allowance Plus for up to the 32nd month after childbirth, i.e., maximum until your child is 2 years and 8 months old.

The Partnership Bonus is an additional benefit that parents can receive if they both receive parental allowance simultaneously and take care of the child together. You can apply for the Partnership Bonus if you and your partner both work part-time, between 24 and 32 hours per week.

The prerequisite for receiving the Partnership Bonus is that both parents/legal guardians receive the bonus simultaneously. And that they both work between 24 and 32 hours per week during this time. If you meet these requirements, you each receive an additional four months of “ElterngeldPlus” or Parental Allowance Plus; i.e. in total, you can receive the parental benefit for eight more months.

For childbirths on 1 September 2021 or later, parents/caretakers can receive a flexible Partnership Bonus for between 2 and 4 months. This means, altogether, they can receive parental allowance between 4 and 8 months longer.

The aim of the Partnership Bonus is for both parents to look after the child together and for a better balance between work and family life to be achieved. The additional months of parental allowance allow you to stay home longer and spend more time with your child.

Single parents are also entitled to the Partnership Bonus if they work between 24 and 32 hours a week.

Important: You can receive the Partnership Bonus for up to 32 months after childbirth. This means at most until your child is 2 years and 8 months old. The Partnership Bonus is not paid automatically– you must apply for it and meet certain requirements, such as working part-time for a certain number of hours.

If you meet these requirements, contact the responsible parental allowance office (“Elterngeldstelle”) and find out about the exact application process.

The amount of parental allowance you receive depends on your living condition and the type of parental allowance you have chosen. According to the law, the amount of parental allowance is based on the amount of monthly net income of each applicant during the last 12 months. Your parental allowance amounts to 65% to 100% of the income you used to have before the childbirth. The higher your prior salary, the lower your parental allowance, i.e. you receive 100% of your previous net income if you are considered to be low-income. Parents who earn more will receive 65% of their previous net income as parental allowance.

Note for parents currently receiving short-time work benefits or unemployment benefits I due to the Coronavirus pandemic: The current months are not taken into account when calculating your parental allowance, so your parental allowance is not reduced because of the short-time work benefit or unemployment benefits I.

Furthermore, there are minimum and maximum limits for the parental allowance. Depending on your previous income, your basic parental allowance ("Basiselterngeld") will be at least €300 and no more than €1800 per month. With the "ElterngeldPlus", you will receive between €150 to €900 per month. In case you did not have any income before the childbirth, you will be entitled to the minimum parental allowance, i.e. €150 or rather €300 per month. Important: If you work while receiving a parental allowance, the amount of your parental allowance will be cut according to your wages.

Families with several small children are also eligible for a so-called "sibling bonus" ("Geschwisterbonus") which amounts to 10% of the designated parental allowance. To apply for the sibling bonus, you must have at least one other child under the age of three or two more children under the age of six. You also receive "sibling bonus" if at least one more child under the age of 14 lives in your household with a disability. The prerequisite is that a degree of disability (GdB) of at least 20 has been established. In the case of multiple births (i.e. twins, triplets, etc.), you also receive a lump sum of €300 for each additional child on top of the Basic Parental Allowance. You will receive a lump sum of €150 for each additional child in addition to Parental Allowance Plus.

With the help of a parental allowance calculator, you can estimate which option (basic parental allowance, "Elterngeldplus", "Partnerschaftsbonus" or a combination of them) is best for you. On familienportal.de, you will find a so-called "quick calculator" as well as a parental allowance calculator which offers you a detailed estimation based on your situation.

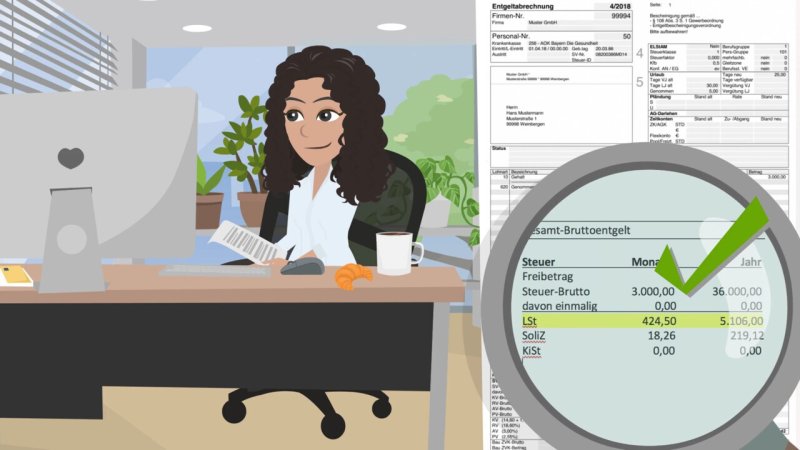

Please note: If you (as a married couple) know early on that you want to apply for parental allowance, you should change your tax bracket ("Steuerklasse ") to increase your net income. The primary parent who will receive parental allowance should switch to tax bracket III. As a father-to-be, you need to do so at least seven months before the childbirth- as a mother-to-be, you are advised to do so before your maternity protection starts. Find out more about taxes in our chapter "Tax return".

Important: You must include parental allowance in your tax declaration. Parental allowance is not taxed, but is considered when calculating your total taxable income at the end of the year. That means that the amount of tax you have to pay may rise. It is, therefore, advisable to set aside and save part of the parental allowance every month.

You need to apply for parental allowance at the parental benefit centre ("Elterngeldstelle") of your federal state. You can find the branch office responsible for you on elterngeld.net. There is an application form which you must complete. You can apply online or send your application to the office responsible per post. You will find the application form as well as the parental benefit centre responsible for you on familienportal.de.

On the application form, you must indicate which parent wishes to receive the parental allowance for which period. You will have the chance to change the allocation and periods once -and, in exceptional cases, twice - later. In case you are married or share custody, both parents/legal guardians must sign the application.

Please note: It is best to apply not according to calendar months but based on the child's exact date of birth and age. If you count calendar months, you will ultimately receive less money.

Make sure you apply on time. Payment of the parental allowance can take place retroactively but only for three months. So, if you file your application too late, you may lose money.

For the application, you need the following documents:

- The birth certificate of your child

- Your salary statements of the last 12 months or a notification from the Jobcenter or alike

- A confirmation letter from your health insurance regarding maternity protection benefit ("Mutterschutzgeld")

- A confirmation from your employer about your parental leave (if applicable)

- A confirmation letter from your employer regarding the maternity allowance grant ("Zuschuss zum Mutterschutzgeld ") for mothers who have been working before childbirth

Please note: If your living conditions change, you must inform the parental benefit centre ("Elterngeldstelle"). If you, for instance, have an additional income, you are obliged to notify them as your income affects the amount of parental allowance to which you are entitled.

Parental allowance is considered as an "income". That means your "Bürgergeld" or social benefits will be reduced according to the amount of your parental allowance. Altogether, you will not receive more money than what you used to before the parental allowance. However, if you were gainfully employed before childbirth, you can claim a so-called "Elterngeldfreibetrag". The amount of such payment depends on the amount of your previous income. You can find out more on arbeitslosenselbsthilfe.org.

If you benefit from compulsory insurance as a member of a statutory health insurance scheme, you can continue with the same coverage. The only difference is that you do not need to make any contributions while receiving a parental allowance unless you are working part-time. In case you are voluntarily insured under statutory health insurance, you can remain covered but usually have to make contributions. The only exception is when you meet the requirements for family insurance.; If that is the case, you do not have to pay dues.

If you were privately insured before receiving a parental allowance, you remain insured there and should continue with your contributions.

Important: There are certain regulations, e.g. for when you are studying or in case you decide to interrupt/pause your parental allowance. Seek advice from your health insurance company before applying for parental allowance. Ask them about the amount of your contributions or when there is a risk of you losing your health insurance coverage.

The parental allowance centre ("Eltergeldstelle") of your federal state can provide you with assistance regarding parental leave. You can find the parental benefit centre responsible for you on Website elterngeld.net. You can also contact an Adult Migration Service or a Youth Migration Service in your area. The staff there speak many languages and specialise in migration and refugee issues. You can find one of their branch offices in your area on bamf.de. If you are 27 or younger, search for a Youth Migration service nearby at jugendmigrationsdienste.de.

Apart from "Elterngeld", only in Bavaria and Saxony, there are other financial support options: the so-called family allowance ("Familiengeld") or state childcare allowance ("Landeserziehungsgeld"). The conditions and regulations for the receipt of these financial aids vary in the two federal states. You can find out all you need to know about the Bavarian family allowance on zbfs.bayern.de. Information about the Saxon state childcare allowance is available on familie.sachsen.de.

On the Family Portal, you can find a calculator which tells you how much parental allowance you will receive.

Find a Parental Allowance Centre nearby where you can seek assistance for your application.

Read this leaflet to learn how to discuss parental leave, re-integration and flexible working models with your boss.